Quote:

Originally Posted by CoolMikey

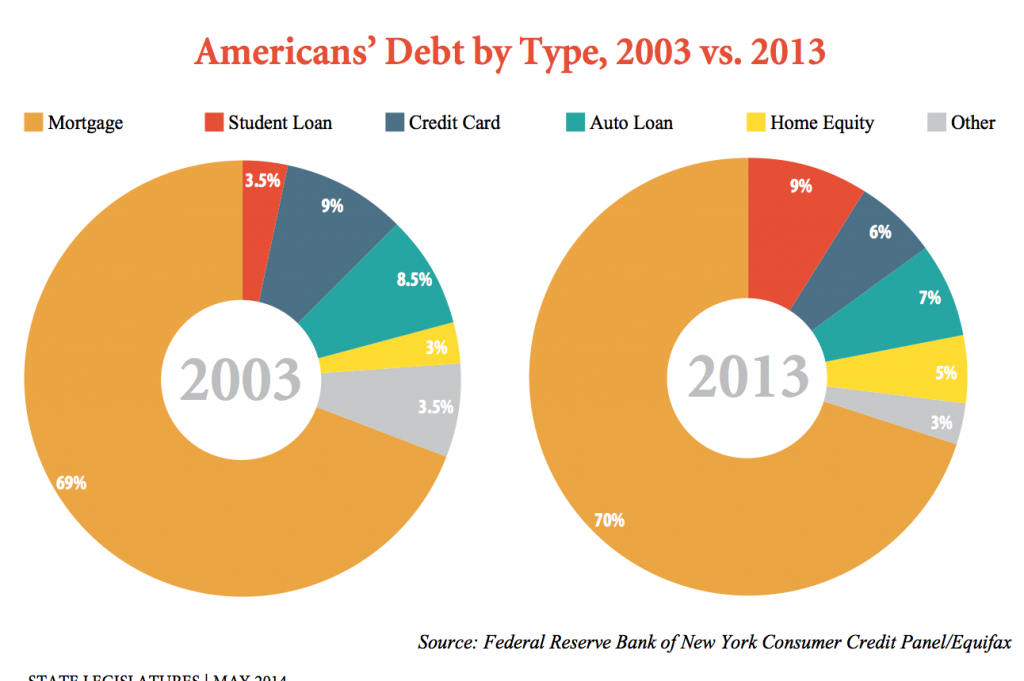

Decent theory, but auto loans account for less than 10% of the mortgage/HELOC loans, so it's unlikely that such a small % could create another economic crisis. There are other differences too, like for example mortgage loans during the last crisis were rated AAA, car loans I'm sure are not, so no one is taking an unexpected risk investing in auto loans now.

|

between your numbers and the reality are 4 years

look here

and here

you also do not have to forget that MUCH more individuals have loans on cars.

so the individual sums will be lower as in the real estate crisis but the number of individual person will be significant higher.

and i did not say that THIS is the crisis already - i just told you where it will start, because behind that is a MASS of consequences what will effect the complete economy.

just a small example:

how many real estate loans are secured with stocks?

what happens with this stocks when the car industry gets a kick in the ass?

how many companies are dierctly connected to the car industry and what will happen to their shares?

what will a bank do when the security they have is not sufficient anymore?

all this steps are following very old and WELL KNOWN rules but they are ignored - same as the real estate crises was ignored even when it was very obvious.