Quote:

Originally Posted by VRPdommy

The fed has no real concern for consumer inflation.

It worries about wage inflation.

That's caused when unemployment hits rock bottom and employers have to raise the wages to attract the needed help from someone else. (competing for workers)

They are on kinda shaky ground because their are so many that are not counted as unemployed. Others that are working multiple part time jobs and plenty of others who are working part time and want full time employment.(underemployed)

Then you have this management overtime without paying overtime issue. That is yet a story for some other thread.

The skinny is they do not really know what the employment 'reserves' are. (uncounted folks that will work but not sign up looking)

But know that rates will only go up when the fed thinks wages are going to rise to fast.

It has nothing at all to do with the price of bread, gas or homes.

However, if you can't control wage growth, it will show up in consumer inflation.

Nobody pays more without passing the cost downstream.

|

None of it works if consumers aren't spending (or borrowing)

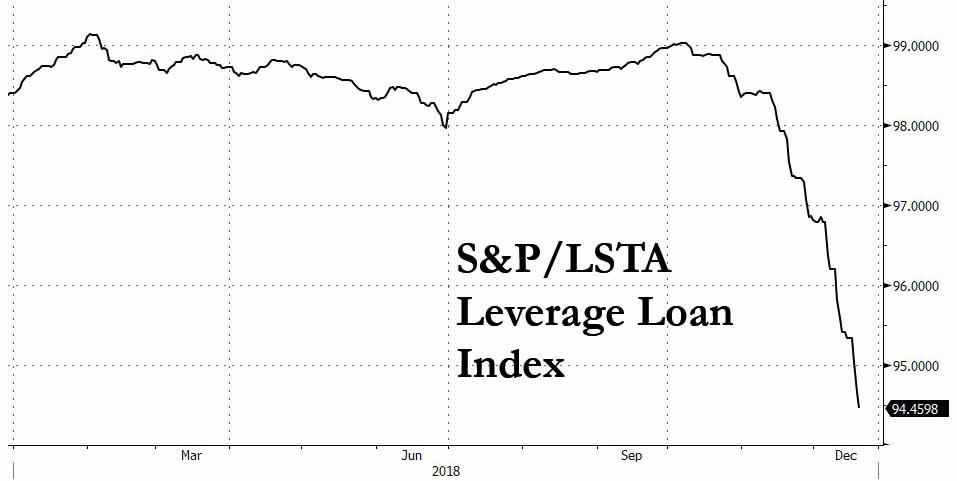

Why Leveraged Loans Are A Better Signal Than High-Yield Bonds

Oct 23, 2018, 06:57am

"So, from a fundamental standpoint, from a technical standpoint and from pure lack of readiness for any weakness, I'd look to the leveraged loan market as the better warning sign for larger problems (if we are going to get them)."

https://www.forbes.com/sites/petertc.../#792d0147e862

The Fed just nailed the coffin shut.... If they wanted it open they would have paused their rate hikes.